Predictive Location Intelligence

Predictive geomarketing – Analytics – Sales efficiency

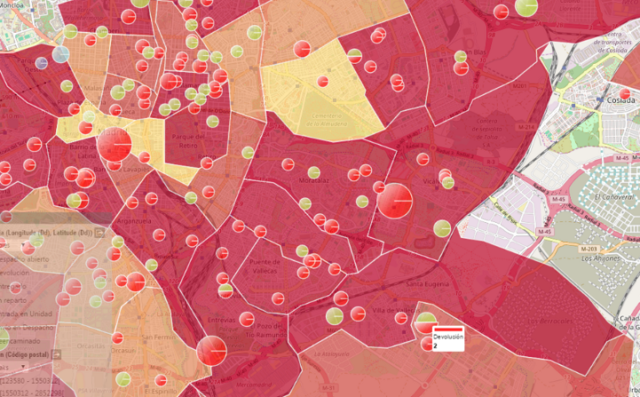

Relevant territorial analysis

What if you could go a whole lot further with mapping? With Galigeo’s location intelligence platform, you can exploit the spatial element contained in every bit of data in order to enhance your analysis capabilities. Create relevant map displays, make meaningful geospatial analyses and take all the right decisions to improve your performance.

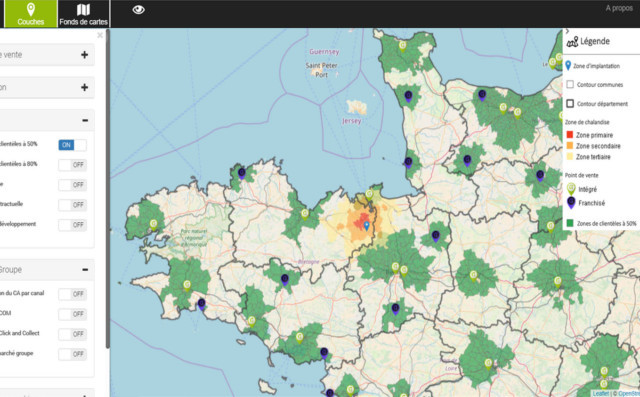

Sales force efficiency out in the field

Galigeo solutions are integrated directly into your CRM. Your sales reps out in the field can use them to view client data on a map and then organise and optimise their sales activities accordingly.

On the management side of things, the geomarketing solution means you can create balanced territories and allocate accounts en masse to the sales reps for those areas.

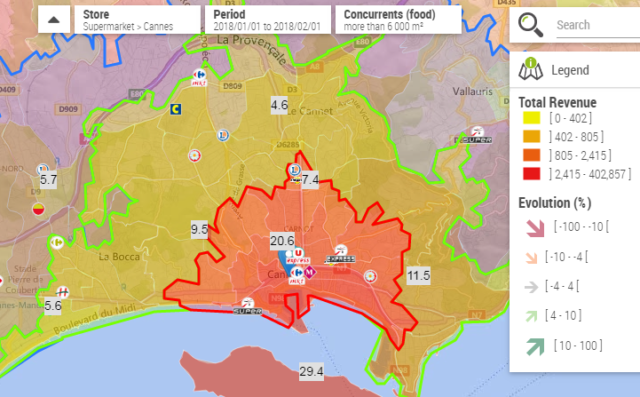

Predictive location intelligence for point-of-sale management

Your Predictive POS solution stimulates the development, management and activities of your point-of-sale (POS) networks. Harnessing the power of location intelligence and predictive modelling, you make better decisions and improve the performance of your points of sale.

Galigeo offers a comprehensive solution of location intelligence applications tailored to company requirements

Easy to use

Galigeo applications are accessible from users’ everyday environment.

Plug and Play

Solutions can be quickly configured and rolled out in all types of organisations.

100 % Compliant

Data stays in your environment and you stay in charge.

Mobile Ready

Generated maps can be used at any time, on a desktop or mobile alike.

Success stories

They put their trust in us.

Police

Improving crime prediction with location intelligence. To bolster its pragmatic approach to the fight against crime, the institution has chosen to rely on Galigeo’s geospatial business intelligence platform.Latest posts

Our Location Intelligence Blog

How Location Data & Analytics help Governments and the Public Sector fight against Coronavirus impacts

20 November 2020 par Vincent Dechandon

The current pandemic is a global crisis that impacts every government - Federal, National or Local - in every country, but that also requires adapted local solutions according to demographics, behaviors, geography or economics. Relying on consistent geolocated data on territories about the situation, needs, resources, material, people… is key for all persons involved in this fight. Location

Alleviate hurricane damage and costs with Location Analytics: The H Insurance story

23 September 2020 par Galigeo

Hurricanes are a recurring source of suffering and stress on people and assets. Rightly so, insurance was invented to diminish the negative consequences on humans and businesses. Climate change has increased the frequency, violence and damage caused by storms. Accordingly, insurers see claim costs increase and policy holders experience higher premiums. Is there a way to stop or reduce this